The Importance of Forex Trading Time: Maximizing Your Opportunities

In the world of forex trading, timing is everything. The foreign exchange market operates 24 hours a day, five days a week, allowing traders to buy and sell currency pairs at any hour. However, not all trading times are created equal. Understanding the significance of forex trading time can greatly enhance your trading strategy and overall success. For those looking to delve deeper into forex trading opportunities, you can explore forex trading time Trading Broker KH, which offers valuable resources and insights. In this article, we will explore the various trading sessions, peak trading times, and how to maximize your trading endeavors.

Understanding Forex Market Hours

The forex market is divided into major trading sessions based on the global financial centers where trading activity is concentrated. The four primary trading sessions are:

- Asia Session: The Asian market opens with the Tokyo session. The trading hours are generally from 11 PM to 8 AM GMT. During this time, trading is influenced by Asian economic news and events.

- London Session: The London session, opening at 7 AM GMT and closing at 4 PM GMT, is known for its high trading volume and volatility. This session often sees increased activity as European traders enter the market.

- New York Session: The New York market opens at 12 PM GMT and closes at 9 PM GMT. The overlap between the New York and London sessions is considered particularly volatile and tends to see the highest trading volume.

- Sydney Session: Opening at 10 PM GMT and closing at 7 AM GMT, the Sydney session usually witnesses lower trading volumes compared to the others but can still yield opportunities for currency pairs influenced by the Asia Pacific economic data.

Peak Trading Times

Understanding peak trading times is crucial for traders looking to maximize their profits. The most active moments occur when two or more trading sessions overlap. The key overlaps in the forex market include:

- London and New York Overlap: This overlap occurs between 12 PM and 4 PM GMT. It is widely regarded as the best time to trade due to the increased volatility and liquidity, resulting in better trading conditions for forex traders.

- Asia and London Overlap: This overlap lasts from 7 AM to 8 AM GMT and, while shorter, can provide opportunities as traders in the London session react to any news from Asia.

Factors That Influence Forex Trading Time

Several factors can influence how traders approach different trading times:

- Economic News Releases: Major economic announcements, such as interest rate changes and employment reports, can significantly impact currency movements. Traders often time their trades around these important news events.

- Market Sentiment: The mood of the market can change dramatically based on geopolitical events or economic stability. Understanding the context of market sentiment is crucial for timing trades effectively.

- Technical Analysis: Many traders utilize various technical indicators to determine entry and exit points. Combining technical analysis with time consideration enhances their trading strategies.

Creating Your Trading Schedule

As you build your forex trading strategy, consider creating a trading schedule that aligns with the market’s peak times and matches your personal trading style. Here are some tips:

- Identify Your Preferred Currency Pairs: Focus on specific currency pairs, especially those that tend to be more active during certain trading hours. This allows you to plan your trading times accordingly.

- Be Aware of Major Economic Events: Keep track of economic calendars and be prepared for increases in volatility. Trade strategically around these events rather than against them.

- Practice Time Management: Allocate specific times for trading, analysis, and monitoring your positions. Consistency is key to becoming a successful trader.

Conclusion

In forex trading, understanding the importance of trading time can significantly impact your performance and profitability. By familiarizing yourself with the market hours, peak times, and external influences, you can develop a more strategic approach to trading. As you explore the forex landscape, remember that timing, like any other factor in trading, requires practice and adaptation. Remain patient, stay informed, and take advantage of the opportunities that the market has to offer.

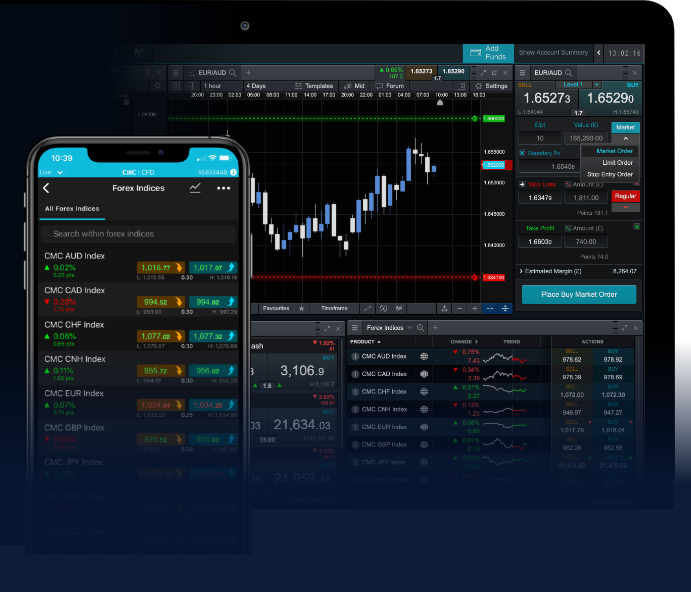

To further enhance your trading journey and make the most out of every trading session, consider leveraging resources provided by various trading brokers and platforms.